RNG on How Copperleaf Helps with Value-based Decision Making

Copperleaf® recently attended the ETG Congress 2019, a scientific forum for the world’s leading energy technology experts, in Esslingen, Germany. At the conference, Martin Knapp, Coordinator of Risk and Portfolio Management at Rheinische NETZGesellschaft (RNG) spoke about how Asset Investment Planning and Management (AIPM) using the Copperleaf Decision Analytics Solution helps RNG develop scenarios to determine the impact of new market shifts on its electricity distribution networks.

RNG manages and operates over 30,000 km of distribution networks for electricity, gas, water, and district heating, for the city of Cologne and surrounding area. RNG uses Copperleaf to optimize its investment portfolios and help improve alignment of its AIPM processes with the ISO 55000 standard.

Adapting to the impact of a growing fleet of electric vehicles on the grid

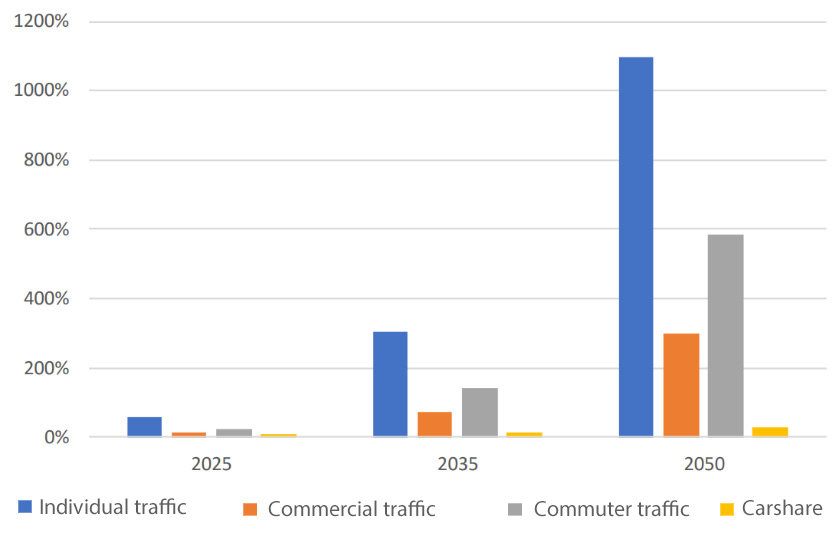

RNG’s baseline scenario for the development of different e-mobility groups

During the presentation, Martin explained how RNG has begun to predict and map “electro-mobility” on its power network over the next 30 years. Power grid operators in large urban areas are faced with the challenge of adapting their grid structures—in the medium to long-term—to accommodate the charging capacity for electric vehicles.

RNG started by analyzing the effect of various scenarios for the future impact of electric vehicles in the Cologne area, based on the following factors:

- Technological: charging power, storage, microgrids

- Social: individual traffic, car sharing, public transport

- Political: quantitative penetration targets, emission requirements

- Commercial: development of corporate fleet

RNG developed a ‘baseline’ scenario that runs until 2050, combining current scientific investigations with market penetration prognoses. The results were also categorized into the various city districts to analyze investment needs in each area.

Mapping both complex management structures and long-term uncertainties with Copperleaf

With the help of Copperleaf, the value measures of planned investments can be visualized, for a specific district, for the entire network, or for a specific asset type.

In addition, variations of the baseline scenario can be developed in order to optimize the value of aggregated investment portfolios. The optimization is based on measurable contributions to capacity expansion and risk reduction under specific constraints such as budget and resources. With these additional scenarios, planning experts can explore the effects of different stages of development on budget and resource requirements and compare potential solutions.

The Copperleaf solution enables RNG to answer crucial questions such as:

- How do technical risks evolve in each scenario in the overall network, in the city districts, or in a resource group (for example, through a shortened life expectancy of old cable sections)?

- Which parts of the city already have an urgent need for action?

- Which scenarios can be undertaken with today’s budget and resources?

- Which scenarios will negatively impact other important strategic projects?

- Which topics must be discussed with external stakeholders such as the municipality or politics?

Value-based Decision Making

With the introduction of an ISO 55000-compliant AIPM solution, RNG designs an objective decision-making process that will help them predict long-term needs and make complex investment decisions with confidence.

By using the Copperleaf solution and implementing a Value-based Decision Making approach, RNG will improve its investment decision-making processes, even in the face of technological innovation and other changes in the market, such as new operator constellations, evolving transparency requirements, or changes in funding.

To learn more about Copperleaf’s approach to Value-based Decision Making, please download our white paper.