How can rail and transit organizations transform their asset investment planning processes to enhance performance, increase connectivity, and transition to a sustainable future?

Our devolved regions need to be able to evaluate their own investment scenarios to make the best decisions possible, especially when increasingly difficult choices have to be made about where money can be spent.

Piers Treacher

Strategic Planning Manager

Network Rail

The Copperleaf solution will enable us to make more complex investment decisions, where economy, capacity, customer satisfaction, sustainability, and other important focus areas can be brought into play.

Rebekka Nymark

Executive Director

Copenhagen Metro

We were looking for an asset investment planning solution that would enable us to consolidate all our existing models on a single platform and support our ambitious plans for their further development.

Andy Kirwan

Head of Advanced Analytics

Network Rail

Decision Analytics for Rail & Transit

Selecting, deploying, and managing capital investments is more challenging than ever before for rail and transit organizations. Replacing aging infrastructure, expanding coverage, and adopting new technologies are all imperative to deliver value today and into the future. At the same time, customer expectations are increasing and the deadline to meet sustainability targets is fast approaching. The challenge is balancing these competing objectives when there aren’t enough resources (money, people, track availability, etc.) to do it all. To navigate these challenges, organizations are rethinking their approach to asset investment planning.

How can you be confident you’re making the best decisions—the ones that maintain service levels today and create value for the future?

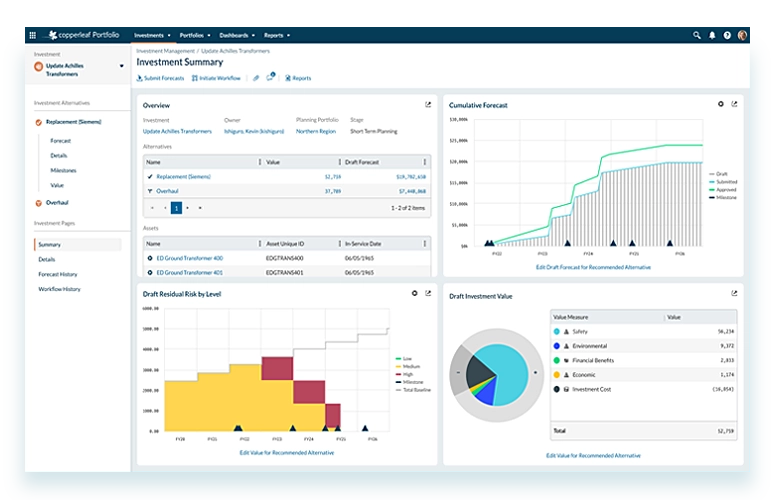

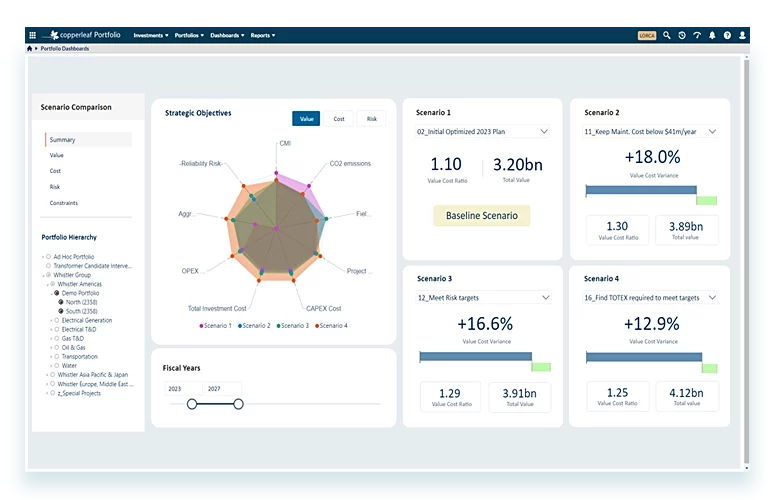

Copperleaf® helps organizations maximize the value delivered from their asset investment plans. By developing frameworks to evaluate all investments on equal footing, we enable our clients to make trade-offs between dissimilar projects and intervention options—from those designed to meet KPIs related to service availability and customer satisfaction, to those that increase capacity or improve employee productivity—and create executable plans that consider all business constraints and targets. The Copperleaf Decision Analytics Solution can help your organization forecast long-term sustainment needs across the diverse asset types that exist within your network, and develop optimal sustainment strategies to manage risk and meet your performance targets cost-effectively.

Proactively Manage Risk Exposure

Explore how different levels of investment impact risk to build a robust, defensible plan.

Improve Planning Efficiency

Assess all investments consistently in a centralized system to break down silos and expedite approvals.

Allocate Funding and Resources with Confidence

Develop executable plans that maximize capital efficiency—while meeting targets and constraints.

Execute Corporate Strategy

Align investments with your strategic goals, including financial, net-zero, ESG, reliability, and other targets.

Proven Solution Delivers High ROI

Every Copperleaf client has achieved 100% return on their investment within their first planning cycle—and every organization that has implemented our solution continues to use it successfully today. Measurable results include:

increase in capital efficiency

reduction in risk exposure

reduction in planning time

Adopted by industry leaders

Network Rail selected the Copperleaf Decision Analytics Solution to help manage Britain’s railway infrastructure, which includes 20,000 miles of track, 30,000 bridges, tunnels and viaducts, and thousands of signals, level crossings and stations. The Copperleaf solution provides an enterprise-wide platform for strategic asset modeling and investment planning. It is being used to forecast work volumes, outputs, and expenditure across Network Rail’s entire asset base.

Create optimal investment plans to drive your strategic goals

Delivering the highest value means doing the right projects at the right time. This is no easy task for organizations that deal with hundreds of potential investment options, with multiple alternatives and start dates to consider.

Copperleaf’s AI-powered optimization can evaluate the vast number of possibilities and identify the optimal plan within minutes. Sensitivity analysis can easily be performed to explore the impact of different funding, timing, and resource constraints on value and risk, and build a realistic, deliverable plan to achieve your strategic goals on schedule.

Proactively manage and mitigate operational risks

Many organizations in the rail industry struggle to forecast sustainment needs across diverse asset types, ranging from track and signals to tunnels and stations. Copperleaf can help your organization forecast and optimize asset performance for the next one to one hundred years by calculating the risk, cost, and value over time for each asset and optimal intervention dates. This allows asset managers to create the best sustainment strategy while accounting for all business constraints.

Plan with agility in a dynamic environment

As your business environment changes, new tactical and strategic priorities emerge. Copperleaf makes it easy to quickly run what-if analyses to explore various investment strategies, build consensus, and align investment decisions with new strategic priorities.

Copperleaf enables a continuous planning process by highlighting variances between planned and actual performance. No matter what twists and turns arise during execution, you’ll be able to re-optimize plans, communicate and defend any changes to stakeholders, and adapt quickly to maintain optimal business performance.

Our Product Suite

Copperleaf’s scalable enterprise software solution can grow with you as your business needs evolve. It integrates seamlessly with existing EAM, APM, ERP, GIS, and other systems for more efficient, data-driven decision-making.

Explore our resources

News

Copenhagen Metro Selects Copperleaf Portfolio to Optimize Investment Planning

Blog

Network Rail: Putting Value at the Core of Asset Management

Blog